cares act stimulus check tax implications

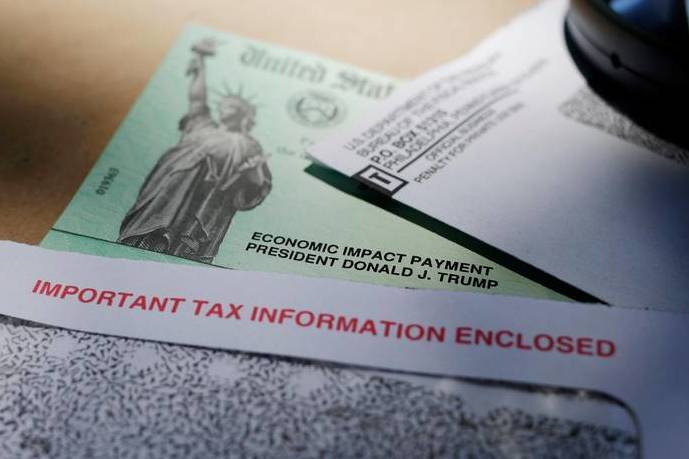

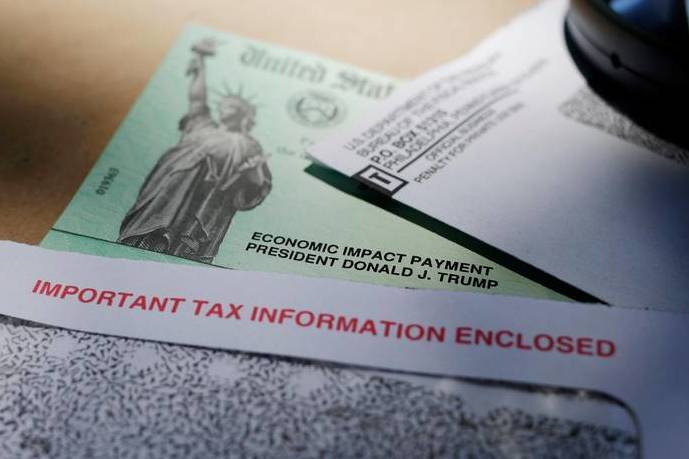

The CARES Act will provide many individuals with a recovery rebate known as a stimulus payment or stimulus check in the next few. Cares act stimulus check tax implications Friday March 18 2022 Edit.

American Rescue Plan How To Get These 1 400 Payments Marca

Single filers who make more than 99000 and joint filers with income exceeding 198000 are not eligible for stimulus payments nor are those over 16 who are claimed as dependents by their parents which includes many college-aged people.

. For individuals who itemize their tax returns lawmakers extended a provision that allowed individuals to deduct qualifying medical expenses that exceeded 75 of their adjusted gross income. When the CARES ACT passed taxpayers were informed they would be receiving a stimulus payment of up to 1200 for single filers 2400 for joint filers plus an additional payment for those who had dependent children. The payments will be 1200 per adult for those with adjusted gross incomes of up to 75000.

You are eligible to get a stimulus check and will receive the FULL amount if you filed taxes and have an adjusted gross income of. Here we outline 5 major tax implications that have stemmed from the new stimulus package. Eligible taxpayers who filed tax returns for either 2019 or 2018 will automatically receive an economic impact payment of up to 1200 for individuals or 2400 for married couples.

An EIP2 payment 23 de jun. Parents also receive 500 for each qualifying child child must qualify for Child Tax Credit. Under the law the Fund is to be used to make payments for specified uses to States and certain local governments.

The stimulus check details are as follows. But what are the tax implications for stimulus checks and unemployment benefits. Here are four things to know about the CARES Act.

The CARES Act allows for a five-year carryback of Federal NOLs generated in tax years beginning in 2018 2019 or 2020 and removes the 80 taxable income limitation for NOL deductions for tax years beginning before January 1 2021 ie it allows an NOL to fully offset taxable income in the temporary window which is the period of time beginning with the. The Coronavirus Aid Relief and Economic Security Act CARES Act established the Coronavirus Relief Fund Fund and appropriated 150 billion to the Fund. Companies are paying employees but dont have to pay the employers share of social security tax 62 of wages from March 27 to Dec 31 2020 per Christine Faris National Tax Director on.

For married couples filing joint returns the income limit to receive a stimulus check is 150000. CARES Act Coronavirus Relief Fund frequently asked questions. The Coronavirus Aid Relief and Economic Security CARES Act was signed into law by President Trump on 32720.

Up to 150000 if married and you filed a joint tax return. The threshold for married couples is 150000 they are eligible for 2400 and 500 per child. There are important tax-related provisions for individuals in the Coronavirus Aid Relief and Economic Security CARES Act Congresss unprecedented economic stimulus package that the.

New York State tax implications of recent federal COVID relief. This article will help you understand what that means for your small business. The CARES Act sends a 1200 stimulus check to eligible adults earning up to 75000.

Check out our Stimulus Check Calculator. If your 2021 income is lower than the 2019 or 2020 income used to determine your eligibility earlier this year you can potentially claim additional stimulus money on your tax return. For individuals who itemize their tax returns.

Up to 75000 if single or you filed taxes married filing separately. The CARES Act allows for a five-year carryback of Federal NOLs generated in tax years beginning in 2018 2019 or 2020 and removes the 80 taxable income limitation for NOL deductions for tax years beginning before January 1 2021 ie it allows an NOL to fully offset taxable income in the. If you were in the 12 percent tax bracket youd reduce your taxes owed by 600 12 percent of 5000.

Tax Implications Of The 2020 Stimulus Check And CARES Act. CARES Act Provides Tax Incentives for Charitable Giving in 2020. Up to 112500 if you filed as head of household.

Individual taxpayers will be receiving a 1200 paymentCouples will receive 2400If you have a qualifying child 16 and under each child will add an additional 500Once taxpayers reach an adjusted gross income threshold of 75000 150000 couple the refundable tax credit begins to phase out at a rate of 5 for every. The stimulus check details are. The federal Coronavirus Aid Relief and Economic Security Act CARES ACT Consolidated Appropriations Act 2021 and American Rescue Plan Act of 2021 contained a number of tax provisions that impact the computation of taxable income for individuals and businesses modify eligibility for certain tax credits and.

Recent changes to the CARES Act resulting from the COVID-19 pandemic will have state and local tax implications for your business.

Stimulus Checks Tax Returns 2021

U S Expats Coronavirus Stimulus Checks Top Faqs H R Block

Usa Finance And Payments Live Updates Gas Stimulus Check Tax Deadline Child Tax Credit Tax Refunds As Usa

Stimulus Check Taxes Will Stimulus Payments Impact Your Taxes

Can You Lose Stimulus Checks If You Don T File Taxes Before 2021 Deadline As Usa

Is A Fourth Stimulus Check Arriving In 2022 Al Com

Stimulus Update How Much You May Receive In Your Third Check

How To Claim Missing Stimulus Payments On Your 2020 Tax Return

What 2022 Means For Stimulus Checks And The Child Tax Credit

How To Stop Child Support From Taking Tax Refund Store 56 Off Www Elmonstruodelasgalletas Com

Irs Admits Mistake In Noncitizens Receiving 1 200 Coronavirus Stimulus Checks Npr

How To Claim A Missing Stimulus Check

You Can Still Get The Child Tax Credit Read This Important Update Right Now

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

New Mexico Tax Rebate 2022 How To Claim The New 500 Checks Marca

Stimulus Check These 11 States Could Have An 850 Payment Coming Marca

3rd Stimulus Check Tax Filing Impact The Child Tax Credit And Other Faqs Abc7 Chicago

Qualified Disaster Distributions Vs Stimulus Checks What Are The Differences Marca